cap-and-trade versus carbon taxes which market mechanism gets the most attention

Cap-and-trade involves setting an economy-wide emissions limit for those sectors under. Cap and trade skeptics argue that giving away permits rather than selling them represents a de facto wealth transfer to large polluters.

Cap And Trade An Overview Sciencedirect Topics

Climatic Change 151 3 605-618 2018.

. Cap-and-trade has one key environmental advantage over a carbon tax. April 9 2007 413 pm ET. Cap-and-trade versus carbon taxes.

A carbon tax system as the name implies forces companies to pay a fixed fee per ton of greenhouse gas emissions GHG. As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. In contrast cap and trade levies an implicit tax on carbon.

This book explores the comprehensive comparison viability and policy considerations of using either a carbon tax or a cap-and-trade programme to offset greenhouse gas emissions. Global climate change is one of Americas most significant long-term policy challenges. Second citizens prefer carbon tax policies that do not grant exemptions to either domestic or foreign firms.

The two systems also differ because choosing between the two could come down to a matter of which performs better under uncertainty. Which market mechanism gets the most attention. The regulatory authority stipulates the.

Several analyses have claimed that a carbon tax is superior to cap and trade in terms of the ability to achieve a fair distribution of the policy burden between polluters firms and consumers to preserve international competitiveness or to avoid problems. It provides more certainty about the amount of emissions reductions that will result and little certainty about the price of emissions which is set by the emissions trading market. We show that the various options are equivalent along more dimensions than often are recognized.

Although cap-and-trade is the most cost-efficient option for firms more revenue from a carbon tax system can be used by the government to fund spending or reduce other taxes. One interesting result from this research is that cap-and-trade wins hands down over carbon taxesit received more and more positive media attention in the. Up to 10 cash back In conclusion in the debate between cap-and-trade or carbon taxes as a market-based solution to climate change cap-and-trade wins hands down in the mediait received more and more positive attention in the national US newspapers in the time period under study than carbon taxes.

In addition we bring out important dimensions along which the. In this paper we examine a potentially key source of this disconnect the. A carbon tax provides certainty about the price but little certainty about the amount of emissions reductions.

As caps reduce the size of the carbon market the increased cost is passed along to consumers in the form of higher prices. A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives. A carbon tax raises a clear amount of revenue which can be used for targeted purposes RD for sustainable energy or rebated to the public in one way or another while the revenues from a cap-and-trade system are likely to be bargained away well before the first trade ever takes place.

It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas emissions. Carbon Tax vs. We show that the various options are equivalent along more dimensions than often are recognized.

The highest carbon tax level 70 per metric ton in the US. Contract renegotiation and rent re-distribution. Journal of Environmental Economics and Management 62 2.

L Kosnik I Lange. Taxes provide automatic temporal flexibility which needs to be built into a cap-and-trade system through provision for banking borrowing and possibly a cost-containment mechanism. Case reduces the probability of support by approximately 30 on average compared to a carbon tax proposal of 10 per metric ton.

In contrast under a pure cap-and-trade system the price of carbon or CO 2 emissions is established indirectly. We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. However experts are divided on the question of which of the two main types of carbon pricing carbon tax and cap-and-trade works best.

Who gets raked over the coals. Carbon tax the price of carbon or of CO 2 emissions is set directly by the regulatory authority this is the tax rate. We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor.

A carbon tax is an explicit tax and Americans are notoriously tax phobic. ABSTRACT Over the past decade voter fraud has emerged as a salient issue in American politics and elections. On the other hand political economy forces strongly point to less severe targets if carbon taxes are used rather than cap-and-trade -- this is not a tradeoff and this is why.

Despite minimal evidence of fraud cases and non-existent effects on election outcomes Americans continue to believe in the existence and impact of voter fraud on elections. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument.

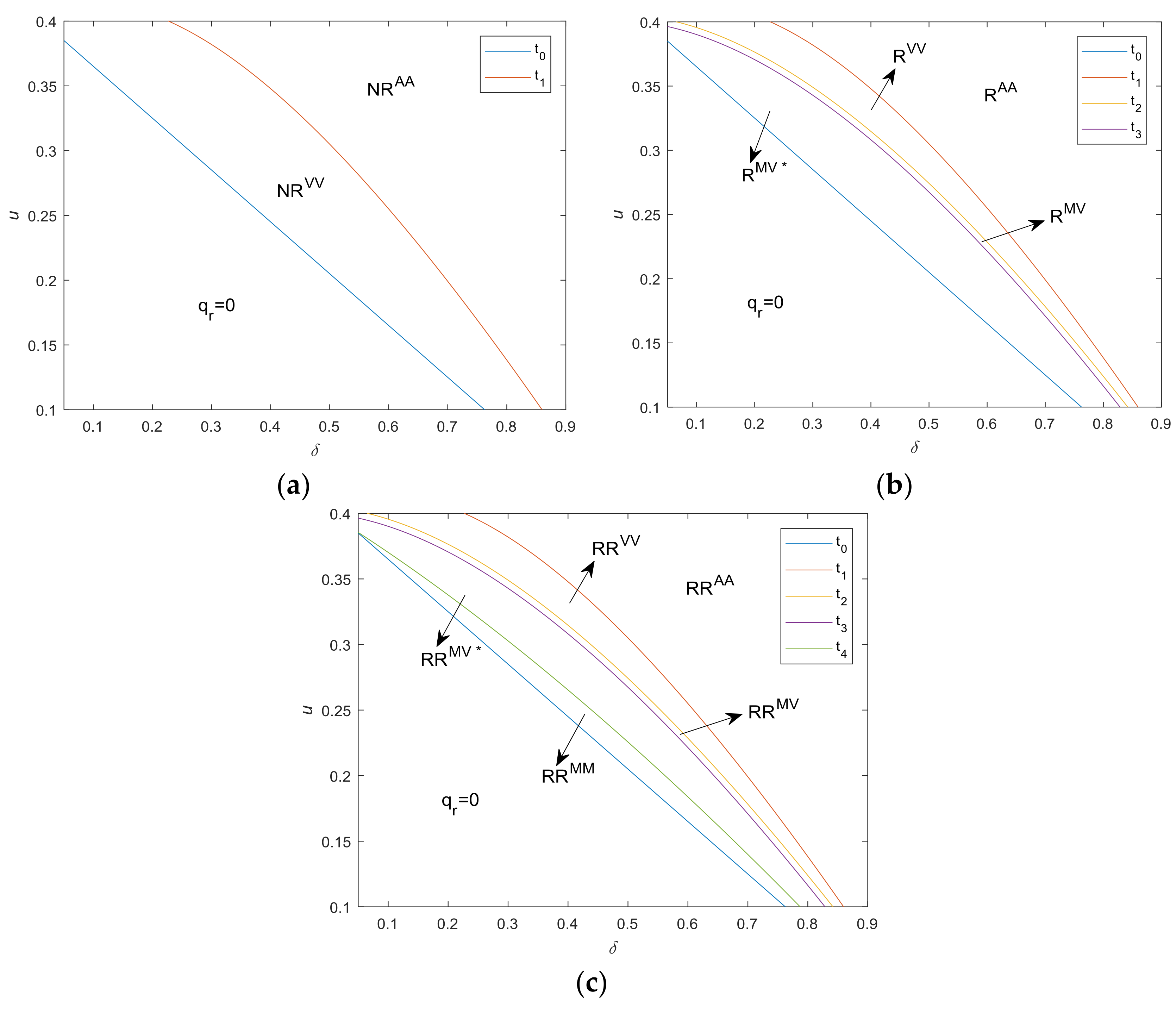

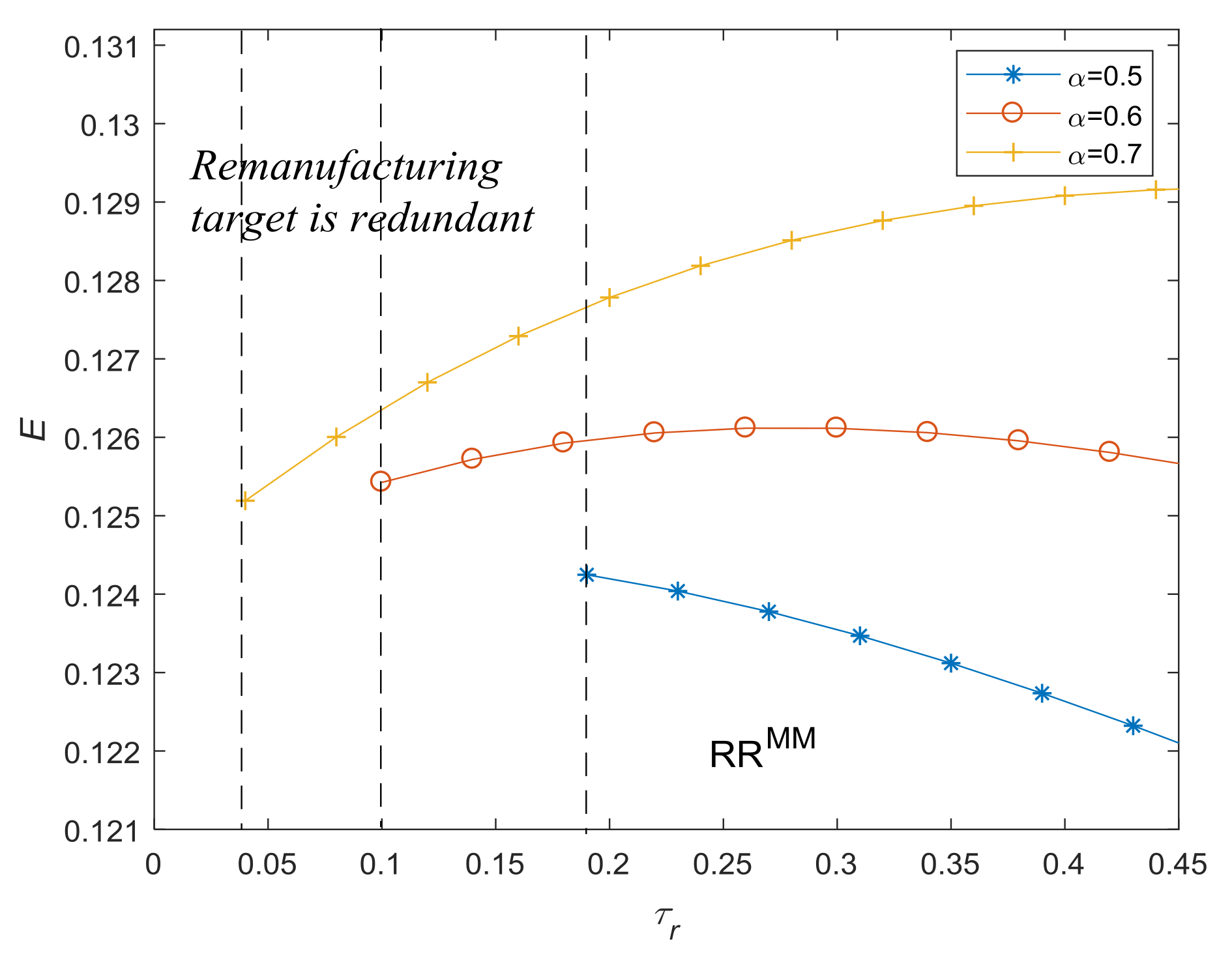

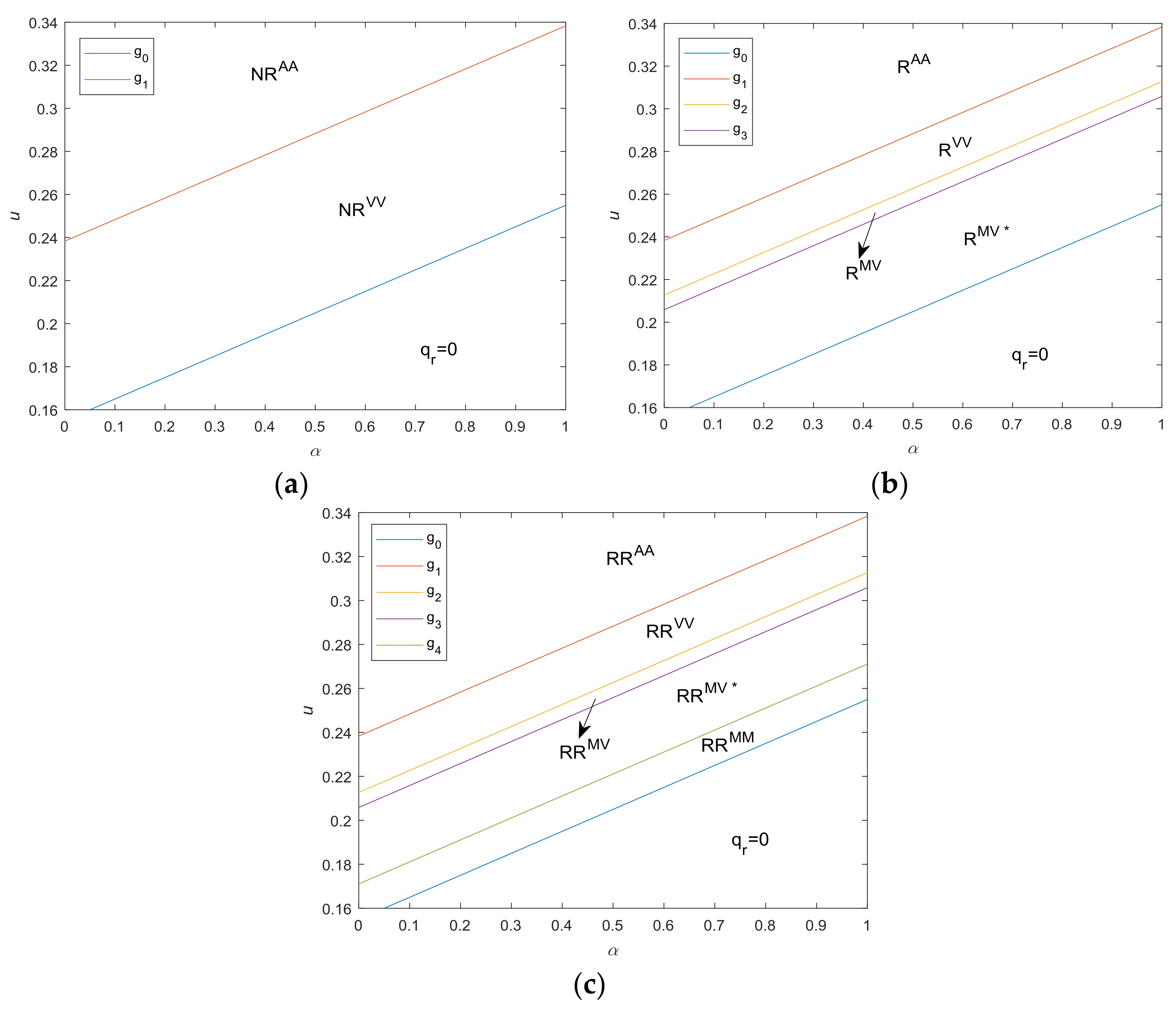

Ijerph Free Full Text Decision Making And Environmental Implications Under Cap And Trade And Take Back Regulations Html

Pdf Tracking Global Carbon Revenues A Survey Of Carbon Taxes Versus Cap And Trade In The Real World

Ijerph Free Full Text Decision Making And Environmental Implications Under Cap And Trade And Take Back Regulations Html

Pdf Tracking Global Carbon Revenues A Survey Of Carbon Taxes Versus Cap And Trade In The Real World

Environmental Economics Permit Markets Britannica

Cap And Trade An Overview Sciencedirect Topics

Chapter 1 What Is The Best Policy Instrument For Reducing Co2 Emissions In Fiscal Policy To Mitigate Climate Change

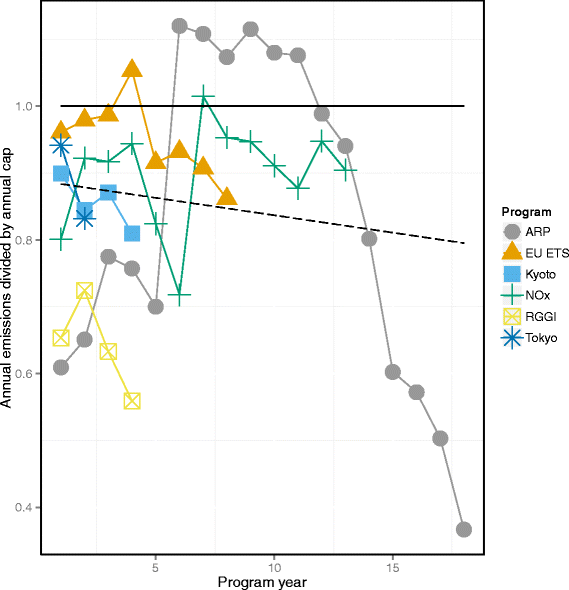

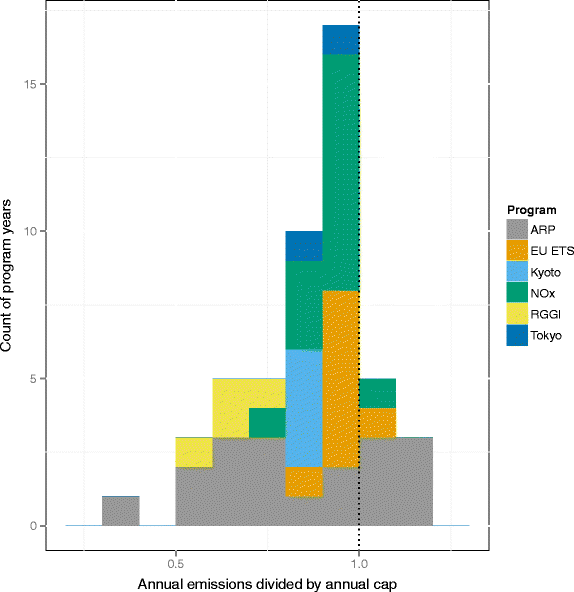

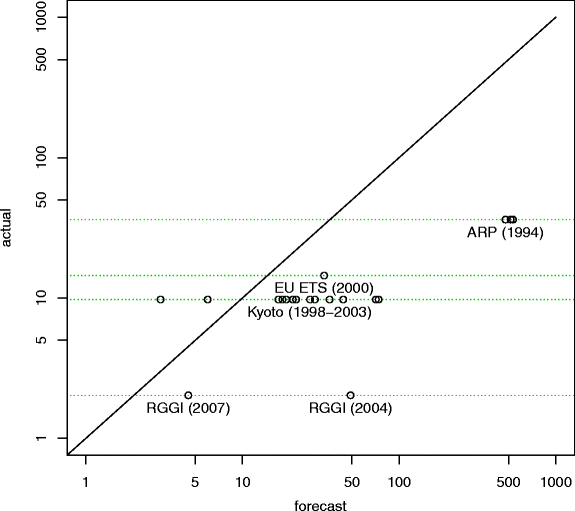

Pdf Lessons Learned From Three Decades Of Experience With Cap And Trade

The Bears Are Right Why Cap And Trade Yields Greater Emission Reductions Than Expected And What That Means For Climate Policy Springerlink

Effects Of A Carbon Tax In The United States On Agricultural Markets And Carbon Emissions From Land Use Change Sciencedirect

The Bears Are Right Why Cap And Trade Yields Greater Emission Reductions Than Expected And What That Means For Climate Policy Springerlink

Pdf Tracking Global Carbon Revenues A Survey Of Carbon Taxes Versus Cap And Trade In The Real World

Ijerph Free Full Text Decision Making And Environmental Implications Under Cap And Trade And Take Back Regulations Html

Ijerph Free Full Text Decision Making And Environmental Implications Under Cap And Trade And Take Back Regulations Html

The Bears Are Right Why Cap And Trade Yields Greater Emission Reductions Than Expected And What That Means For Climate Policy Springerlink

Pdf Tracking Global Carbon Revenues A Survey Of Carbon Taxes Versus Cap And Trade In The Real World